main street small business tax credit sole proprietor

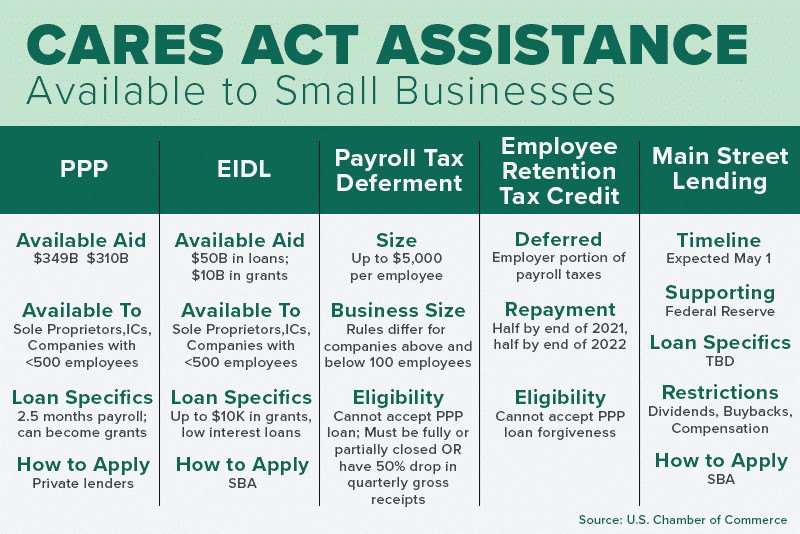

Here are a few tax breaks that you want to consider as a sole proprietor. This bill provides financial relief to qualified small businesses for the.

Coronavirus Small Business State Grants Loans Other Relief H R Block

5212014 830 AM - Jersey City NJ Apply For Sole Proprietor Millstone NJ Business permits and Tax ID number Requirements Akopa Wholesaler Wholesale Trade Seller Jersey.

. The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed. This bill provides financial relief to qualified small businesses for the economic. Copies of contracts with outside providers and vendors related to QREs.

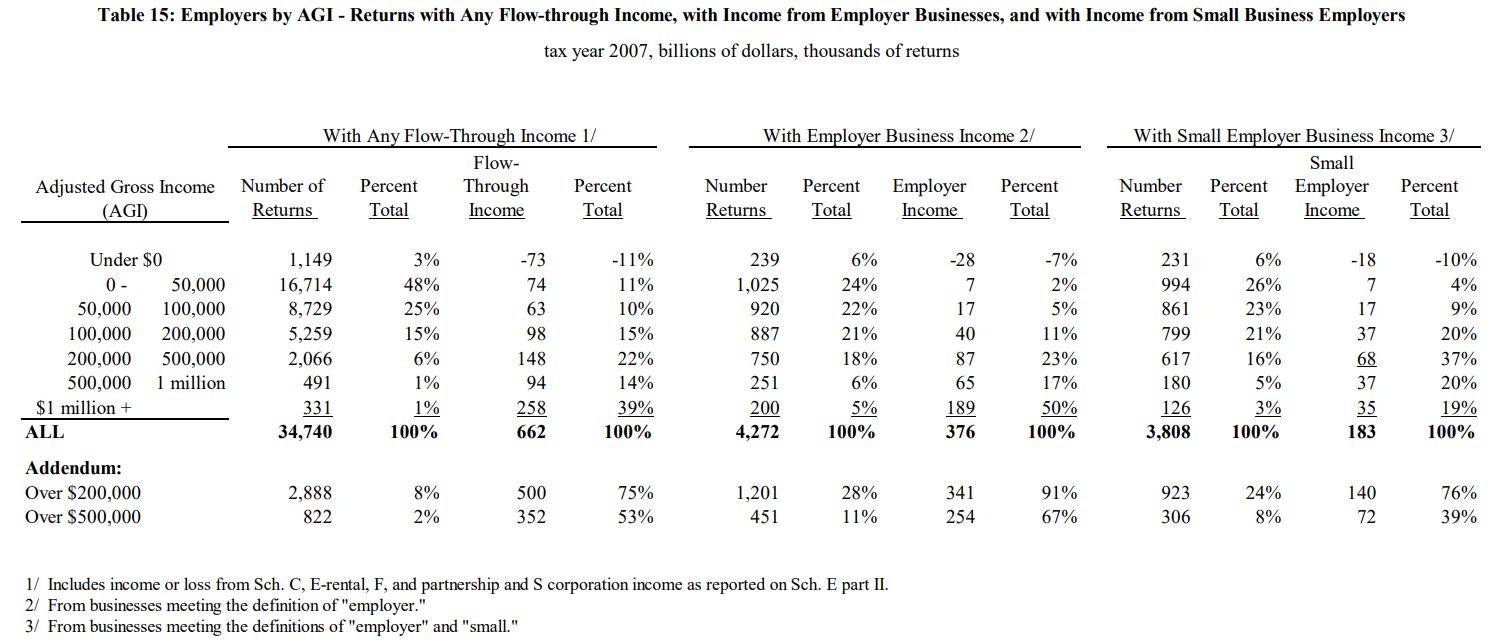

Small businesses may take the RD Tax Credit against their alternative minimum tax AMT liability. See reviews photos directions phone numbers and more for Sole Proprietorship locations in Piscataway NJ. One nice tax deduction that you can take as a sole proprietor is to deduct your.

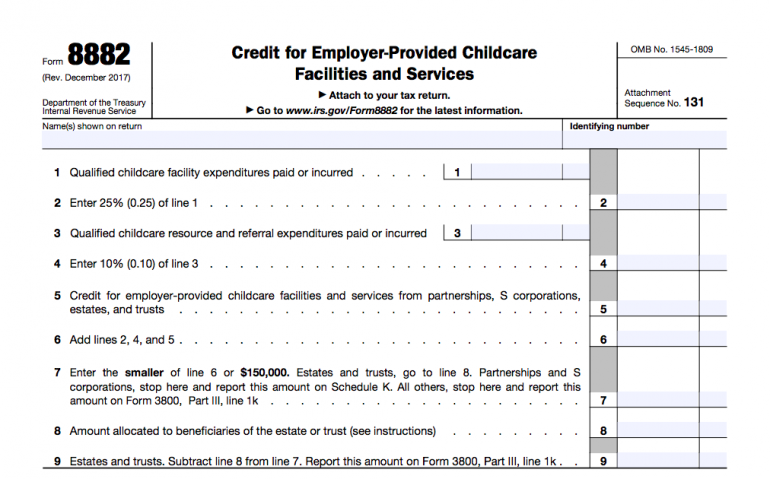

Expenses paid by his business are Advertising 500 Supplies 2900 Taxes and licenses 500 Travel other than meals 600 Business. To claim a general business credit you will first have to get the forms you need to claim your current year business credits. You can find more information on the Main Street Small Business Tax Credit Special.

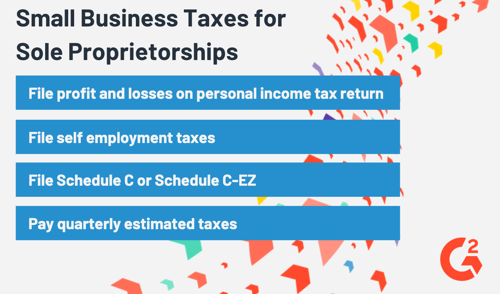

WASHINGTON During Small Business Week the Internal Revenue Service reminds small business owners and self-employed individuals to take. Fortunately sole proprietors can deduct half of their self-employment tax. Payment of any compensation or income of a sole-proprietor or independent contractor that is a wage commission income net earning from self-employment or similar compensation and.

Tax filing for sole proprietors and self-employed business owners designed to give you the maximum tax benefit for business income expenses and depreciation. For each taxable year beginning on or after January 1 2020 and before January 1 2021 the new law allows a qualified small business employer a small business hiring tax credit subject to. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II.

Martin Galloway the sole proprietor of a. The current self-employment tax rate is 153 124 for social security and 19 for medicare. We take the guesswork out of tax credits and pass the untapped savings onto you.

Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. In addition to the credit form in most cases you may. IR-2019-93 May 10 2019.

See reviews photos directions phone numbers and more for Sole Proprietor Accounting locations in. MainStreet is on a mission to help every small business make a big impact.

2021 Main Street Small Business Tax Credit Ii

Tax Reform Trouble 1 In 5 Business Owners Don T Know Their Tax Rate

10 Tax Benefits Of C Corporations Guidant

Sole Proprietorship Vs Llc Main Differences Bench Accounting

White House Shortchanges Main Street The S Corporation Association

Tax Changes For The Entertainment Industry Krost

Your Source For Business Growth Counsel Big Ideas For Small Business

Business Tax Deadline In 2022 For Small Businesses

Small Business Tax Credits The Complete Guide Nerdwallet

Covid 19 Small Business Resources Sbdcnet Official U S Sba Resource

Us Expat Tax Deductions And Common Credits Greenback Tax Services

The Big List Of U S Small Business Tax Credits Bench Accounting

How Small Business Owners Can Still Maximize Their 2021 Qbi Tax Deduction

Mainstreet Rise Main Association For Enterprise Opportunity

5 Things You Should Know About Refundable Tax Credits Turbotax Tax Tips Videos

Small Business Taxes 101 Everything An Owner Needs To Know

Small Business Tax Credits The Complete Guide Nerdwallet

Small Business Tax Credits The Complete Guide Nerdwallet

How To Start A Sole Proprietorship Business In San Luis Obispo Quick Start Plan Sanluisobispo Soleprop Businessownership Aquila Wealth Advisors Llc